I'm glad I did it then.. Considering here in Texas it's in the upper 90's in the afternoon.. Those damn trucks need ac.

Tracking my shipment from somewhere in Oregon.

Collapse

X

-

-

Originally posted by Eiger View PostWhew! Just got my Skruf in, and I'm enjoying a bit right now. Mmmmm, Skruuuuf. I hope they go ahead and pony up their info before I'm ready to make another order. I need them to get off that banned list. Happy snusing all.

Great to hear as a fellow Oregonian Skruf fan!!!!!

Damn Nice!

My anxiety has gone down one notch.

--

Did they take out the Oregon Tax? I found some places are not

charging the Oregon tax correctly. It is now taxed by weight not

65 % of wholesale price. It changed January 1.

-

http://www.oregon.gov/DOR/TOB/smokeless.shtml

Smokeless tobacco products weight-based tax changes

With the passage of House Bill 2672 the tax rate changes for smokeless tobacco products will be effective January 1, 2010 and apply to all smokeless tobacco products distributed on or after this date.

Moist Snuff Weight-Based Tax FAQs

How does Oregon tax tobacco products?

Oregon Revised Statutes (ORS) chapter 323 discusses how tobacco products are taxed in Oregon and related administrative requirements. The general categories below have a different treatment.

- Cigarettes – are taxed by application of an Oregon cigarette tax stamp. The current tax rate is $1.18 per package of 20 cigarettes.

- Cigars – are taxed on 0.65 percent of the purchase price paid on untaxed cigars except that the maximum tax on cigars that cost $0.77 or more “each” is limited to $0.50 per cigar.

- NEW – Moist Snuff – the tax is $1.78 per ounce except that the minimum tax paid per retail unit is $2.14 per unit. This begins on January 1, 2010.

- All Other Tobacco Products - are taxed on 0.65 percent of the purchase price paid on untaxed tobacco products.

When is the new tax calculation for moist snuff effective?

January 1, 2010.

What is “moist snuff”?

Moist snuff is any finely cut, ground, milled or powdered tobacco product that is not intended to be smoked or placed in the nasal cavity. Moist snuff also includes any product containing tobacco which is not intended to be burned when consumed. Examples include items such as chewing tobacco, lozenges, strips, and sticks. It does not include things like cigarettes, roll-your-own tobacco, pipe tobacco or cigars.

I am an Oregon-licensed tobacco distributor. How do I pay the tax on moist snuff?

Your quarterly tobacco tax returns will be sent to you as they have in prior years. The tax returns and schedules have seen significant changes for 2010.

I purchased moist snuff over the internet for personal use. How do I pay the tax on the moist snuff I purchased?

You will find Form 531, Oregon Quarterly Return for Tobacco Products, on our website at http://www.oregon.gov/DOR/TOB/forms-tobacco.shtml. You will need to complete and submit this return and supporting schedules with payment to the Department of Revenue for each calendar quarter in which you purchase moist snuff or other tobacco products.

When is my tax return due?

Tobacco tax returns are due on the last day of the month following the calendar quarter for which a tax return is required. For example:

January 1 – March 31 Due by April 30 April 1 – June 30

Due by July 31 July 1 – September 30 Due by October 31 October 1 – December 31 Due by January 31

Comment

-

Since it came by UPS, you should definitely take care of the paperwork yourself and pay those taxes because UPS is a government informer and the feds will hit you up for not only taxes, but late fees and penalties, which cost more than the taxes ever would have cost. I speak from experience from when I used to buy cigarettes from the Indians by UPS and, years later, long after I had quit smoking, was hit with late fees and penalties amounting to over $800.

Edit: This is why the PACT act happened. That's why it is now illegal to ship tobacco products via the USPS. It's because UPS gives the government all of your personal information and the USPS doesn't.

Comment

-

You're so right, and it was worth 30 to 40 million dollars a year in USPS revenue from the Indians.Originally posted by dreed2 View Post.. UPS gives the government all of your personal information and the USPS doesn't.

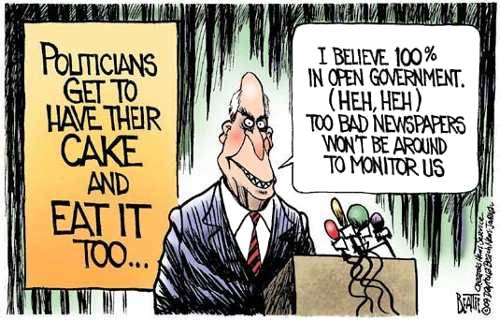

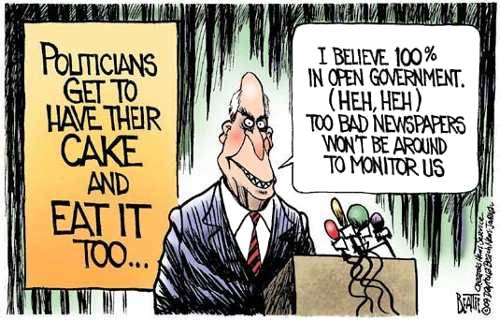

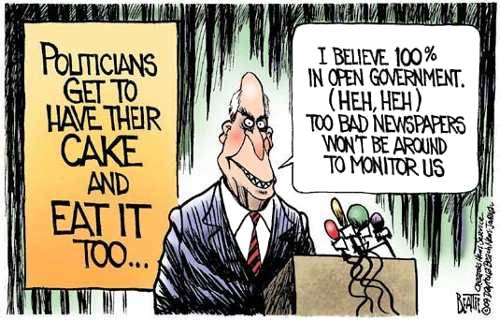

And now, thanks to the PACT Act, USPS can go under quicker. All tobacco-related businesses are affected profit-wise but the damn politicos still want their tax grafts!

We have a fiscal duty to feed those gluttonousall our coins?!?

Comment

-

Yes, unfortunately, you are 100% correct.Originally posted by snusgetter View PostYou're so right, and it was worth 30 to 40 million dollars a year in USPS revenue from the Indians.

And now, thanks to the PACT Act, USPS can go under quicker. All tobacco-related businesses are affected profit-wise but the damn politicos still want their tax grafts!

We have a fiscal duty to feed those gluttonousall our coins?!?

Comment

-

Can I be one of them chosen few?

Originally posted by dreed2 View PostYes, unfortunately, you are 100% correct.- I, too, believe in 100% open government and I'd like to have my cake and eat it too

- I will share some of my cake crumbs with some of my constituents and other down-trodden

- If elected, I will do my best not to dishonor the secret code of misconduct of my chosen office

- If not elected, I will do my best to sully the name and reputation of the winner

- yada yada yada

VOTE FOR ME

VOTE EARLY

and

VOTE OFTEN

Truthfully, I'd rather have your cake and save mine for retirement.

Comment

-

Right. Let's cheer for the USPS to go bankrupt.Originally posted by snusgetter View PostYou're so right, and it was worth 30 to 40 million dollars a year in USPS revenue from the Indians.

And now, thanks to the PACT Act, USPS can go under quicker. All tobacco-related businesses are affected profit-wise but the damn politicos still want their tax grafts!

We have a fiscal duty to feed those gluttonousall our coins?!?

Boycott USPS for parcels.

Comment

-

My order was shipped today and it says on timeOriginally posted by Eiger View PostI did not use the express UPS option, just the standard. However, I placed my order on the 28th (product coming out of Sweden) and received it on the 30th, which I thought was pretty damn fast. Obviously it went air all the way. This was my first order through Buysnus, so this may not be typical. I'm normally a Northerner customer, and they generally take 8 days to deliver from PA.

for Wednesday arrival.. Very fast

Comment

Related Topics

Collapse

-

So, if you ever wondered why it takes so long to get your snus, this might explain it. UPS is finally done playing "hot potato" with my...

-

Channel: Snus Talk

-

-

by Joe234

-

Channel: People and World Around Us

-

-

by CrowWashington followed Oregon in allowing terminally ill patients to get a prescription for drugs that will hasten death. Critics of such laws feared that...

-

Channel: People and World Around Us

12-08-12, 10:33 PM -

-

by Joe234FBI thwarts terrorist bombing attempt at Portland holiday tree lighting, authorities say

Published: Friday, November...-

Channel: People and World Around Us

-

-

by Joe234Ch 12 Declares Victory for Legal Pot in Oregon by 63%

http://www.kptv.com/story/27273055/m...de-on-legaliza...-

Channel: People and World Around Us

-

- Loading...

- No more items.

Links:

BuySnus.com |

SnusExpress.com |

SnusCENTRAL.com |

BuySnus EU |

BuySnus.at |

BuySnus.ch |

SnusExpress.ch

Comment