UGGH!! The Gob'ment Is Taking My Savings Lil By Lil.....

Collapse

X

-

Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to hide the bodies of the people I killed because they were annoying......

I've been wrong lots of times. Lots of times I've thought I was wrong only to find out that I was right in the beginning.

-

-

gold hit $1911.00 today. Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to hide the bodies of the people I killed because they were annoying......

Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to hide the bodies of the people I killed because they were annoying......

I've been wrong lots of times. Lots of times I've thought I was wrong only to find out that I was right in the beginning.

Comment

-

-

yea well it would be nice except I wanted to buy more in a week or so. It will be up to 2k by then. Not sure I want to invest at that price. But I'm sure I will bite the bullet one more time. I paid in the mid $1700s about 10 days ago, that sucked enough.

Since I invested in the gold, silver and more of my safe stocks I have been watching all three quite a bit. Its really apparent that as the stock market goes to hell the price of gold goes up. However, there were a few days that the stocks were doing really well and gold was still going up. I really can't see gold going down any....ever. I think that a lot of people were holding off on buying gold [like myself] untill things really got bad in the market. Then they made the plunge.

BTW, the stocks that I bought went up like crazy for a few days then the hit the crapper and are slowly going up now. Luckily that stock never got close to as cheap as I actually paid for it.......except the day I bought it. Its pretty dam safe. Got lucky for once. Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to hide the bodies of the people I killed because they were annoying......

Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to hide the bodies of the people I killed because they were annoying......

I've been wrong lots of times. Lots of times I've thought I was wrong only to find out that I was right in the beginning.

Comment

-

-

I can't tell you how historically wrong you are PP, don't invest in it like it will never lose money as that is impossible for it to remain going up or staying the same. It will never happen.Originally posted by Premium ParrotsI really can't see gold going down any....ever.

George Soros sells his gold - George Soros, the hedge fund investor who called gold "the ultimate bubble", has sold almost his entire holding of the precious metal, leading to fears that the price is about to fall.

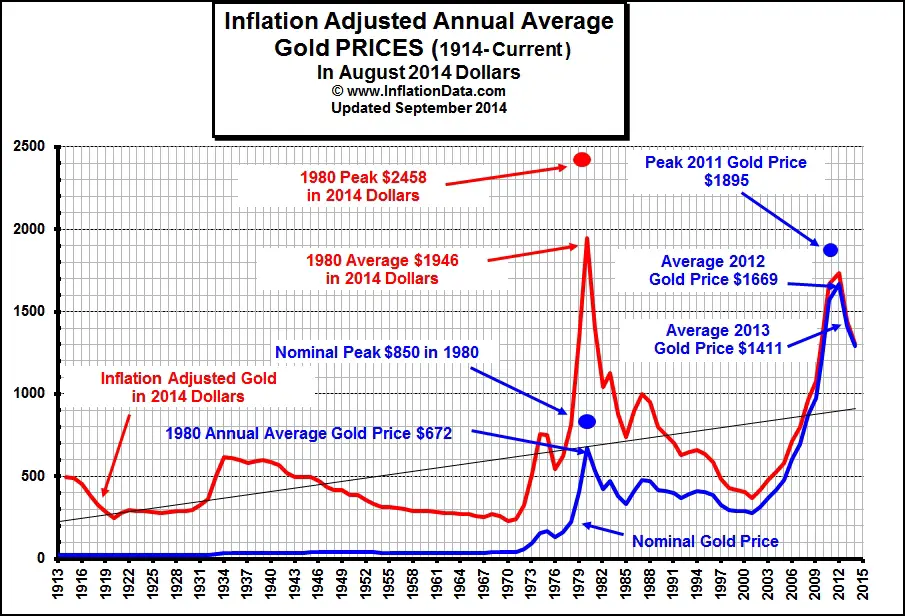

The people who thought Gold wasn't a bubble in the 80's lost out big due to thinking like this:

Comment

-

-

I've found several graphs that show the price of gold over the years. All other graphs show the actual current price of gold in todays prices. Looks to me like it fluctuates somewhat but has continually gone up in price. Every source that I can find shows like this.

http://www.nma.org/pdf/gold/his_gold_prices.pdf

Either way, I believe most people buy gold to hold, if it goes up in price, then great.Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to hide the bodies of the people I killed because they were annoying......

I've been wrong lots of times. Lots of times I've thought I was wrong only to find out that I was right in the beginning.

Comment

-

-

lmao gold is down to about $1750 currently. The poor bastards that bought gold 2 days ago and paid over $1900 must be shitting in their pants. Sure glad I bought when I did.Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to hide the bodies of the people I killed because they were annoying......

I've been wrong lots of times. Lots of times I've thought I was wrong only to find out that I was right in the beginning.

Comment

-

-

Gold posts biggest drop since 1980 on Fed fearsOriginally posted by Premium Parrotslmao gold is down to about $1750 currently. The poor bastards that bought gold 2 days ago and paid over $1900 must be shitting in their pants. Sure glad I bought when I did.

NEW YORK (Reuters) - Gold futures fell more than $100 on Wednesday, one of the steepest falls ever, as strong U.S. economic data and expectations of more Federal Reserve stimulus accelerated profit taking from the safe-haven record high of a day ago.

Selling spiraled out of control as money managers competed to liquidate positions in COMEX futures, which experienced their biggest single-day dollar loss since 1980. Volume looked like a record.

The price of gold bullion is now more than $150 below Tuesday's all time high of $1,911.46 an ounce, downed by intense speculation about whether the Fed will announce new plans to ease monetary policy at a meeting late this week.

Analysts said it was time for gold investors to take money off the table after the rally extended too far, too fast in recent weeks. Bullion rose as much as $400 since July.

"You have a commodity that retail investors, hedge funds and everybody were long, and the technical indicators showed it was overbought. It was just a matter of time before the market starts cracking," said Mihir Dange, COMEX gold options floor trader for Arbitrage LLC.

Spot gold was down 4.1 percent to $1,754.59 an ounce by 3:37 p.m. EDT, off its session low of $1,749.39.

Before gold began recoiling Tuesday from above $1,900, it had risen nearly 9 percent over six sessions.

U.S. gold futures for December delivery settled down $104 at $1,757.30 an ounce. Reuters data showed that is the biggest price drop of the continuous, front-month contract since January 22, 1980, when it tumbled almost $150. On a percentage basis, it was the steepest fall since December 2008, during the financial crisis.

COMEX futures volume topped 430,000 lots, on pace to surpass a record from August 9, preliminary Reuters data showed.

Silver dropped 5.9 percent to $39.34 an ounce.

Gold came under pressure after steadying overnight, after a report showing new orders for U.S. durable goods orders rose 4 percent in July, more than expected and offering hope the ailing economy could dodge a second recession.

Analysts warned of a sharp correction from this month's rally was possible, especially if Friday's central bank meeting at Jackson Hole, Wyoming does not result in a Fed announcement of a third round of government bond buying, or quantitative easing, also known as QE3.

MORE

Is this really only a correction in the market ........ or the beginning of further drastic plunges??

Comment

-

Related Topics

Collapse

-

by sgreger1For those intirested in what exactly the allegations against Goldman Sachs are, and a laymens explanation of what happened during the crisis, including...

-

Channel: People and World Around Us

-

-

by wa3zrmFor Star Trek Deep Space Nine Fans...

The Ferengi Rules of Acquisition as told by Quark

1) Once you have their...-

Channel: People and World Around Us

06-05-10, 02:07 PM -

-

by wa3zrmTEC ^ |

Are you thinking of going to college? If so, please consider that decision very carefully. You probably have lots of people telling...-

Channel: People and World Around Us

-

-

by precious007I'd like to write this post especially for the members of the forum that are still smoking (has nothing to do with snusing) which is a whole different...

-

Channel: precious007

16-01-12, 09:32 PM -

-

by sgreger1Some of the members, particularly those from high-tax states, need some assistance from their Snuson bretheren. The idea has been proposed that we could...I live in a high-tax state and would be willing to contribute towards a bulk order0%0I live in a low-tax state and would be willing to have a bulk order shipped to me0%0No, that just won't work for me0%0

-

Channel: People and World Around Us

-

- Loading...

- No more items.

Links:

BuySnus.com |

SnusExpress.com |

SnusCENTRAL.com |

BuySnus EU |

BuySnus.at |

BuySnus.ch |

SnusExpress.ch

Comment