Coming in a few months:

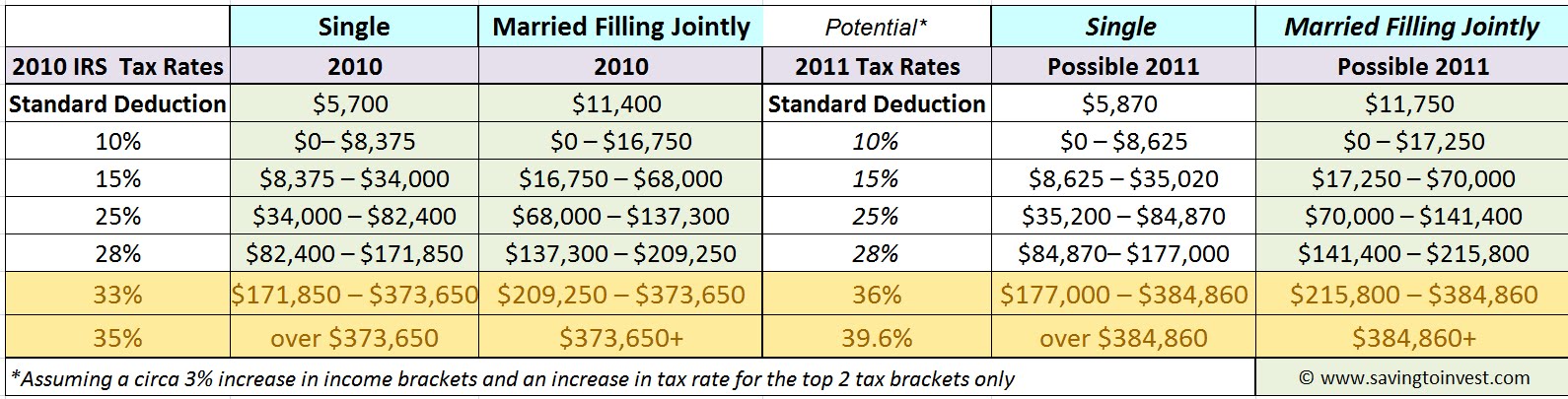

1. The lowest bracket for the personal income tax is going to increase from 10 percent to 15 percent.

2. The next lowest bracket for the personal income tax is going to increase from 25 percent to 28 percent.

3. The 28 percent tax bracket is going to increase to 31 percent.

4. The 33 percent tax bracket is going to increase to 36 percent.

5. The 33 percent tax bracket is going to increase to 36 percent.

6. In 2011, the death tax is scheduled to return. So instead of paying zero percent, estates of $1 million or more are going to be taxed at a rate of 55 percent

7. The capital gains tax is going to increase from 15 percent to 20 percent.

8. The tax on dividends is going to increase from 15 percent to 39.6 percent.

9. The "marriage penalty" is also scheduled to be reinstated in 2011.

10. Dozens of health care reform taxes

It is being estimated that the total cost of these tax increases to U.S. taxpayers will be $2.6 trillion through the year 2020.

Lowest tax brackets increasing, capital gains tax increasing, dividends tax increasing, penalty for being married, tax for healthcare? Can someone explain to me how this only effects the rich like I keep hearing everywhere in the news?

And lets not forget about all the other taxes Americans already pay

Accounts Receivable Tax

Building Permit Tax

Capital Gains Tax

CDL license Tax

Cigarette Tax

Corporate Income Tax

Court Fines (indirect taxes)

Dog License Tax

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Fuel permit tax

Gasoline Tax

Gift Tax

Hunting License Tax

Inheritance Tax

Inventory tax IRS Interest Charges (tax on top of tax)

IRS Penalties (tax on top of tax)

Liquor Tax

Local Income Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Payroll Taxes

Property Tax

Real Estate Tax

Recreational Vehicle Tax

Road Toll Booth Taxes

Road Usage Taxes (Truckers)

Sales Taxes

School Tax

Septic Permit Tax

Service Charge Taxes

Social Security Tax

State Income Tax

State Unemployment Tax (SUTA)

Telephone federal excise tax

Telephone federal universal service fee tax

Telephone federal, state and local surcharge taxes

Telephone minimum usage surcharge tax

Telephone recurring and non-recurring charges tax

Telephone state and local tax

Telephone usage charge tax

Toll Bridge Taxes

Toll Tunnel Taxes

Traffic Fines (indirect taxation)

Trailer registration tax

Utility Taxes

Vehicle License Registration Tax

Vehicle Sales Tax

Watercraft registration Tax

Well Permit Tax

Workers Compensation Tax

1. The lowest bracket for the personal income tax is going to increase from 10 percent to 15 percent.

2. The next lowest bracket for the personal income tax is going to increase from 25 percent to 28 percent.

3. The 28 percent tax bracket is going to increase to 31 percent.

4. The 33 percent tax bracket is going to increase to 36 percent.

5. The 33 percent tax bracket is going to increase to 36 percent.

6. In 2011, the death tax is scheduled to return. So instead of paying zero percent, estates of $1 million or more are going to be taxed at a rate of 55 percent

7. The capital gains tax is going to increase from 15 percent to 20 percent.

8. The tax on dividends is going to increase from 15 percent to 39.6 percent.

9. The "marriage penalty" is also scheduled to be reinstated in 2011.

10. Dozens of health care reform taxes

It is being estimated that the total cost of these tax increases to U.S. taxpayers will be $2.6 trillion through the year 2020.

Lowest tax brackets increasing, capital gains tax increasing, dividends tax increasing, penalty for being married, tax for healthcare? Can someone explain to me how this only effects the rich like I keep hearing everywhere in the news?

And lets not forget about all the other taxes Americans already pay

Accounts Receivable Tax

Building Permit Tax

Capital Gains Tax

CDL license Tax

Cigarette Tax

Corporate Income Tax

Court Fines (indirect taxes)

Dog License Tax

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Fuel permit tax

Gasoline Tax

Gift Tax

Hunting License Tax

Inheritance Tax

Inventory tax IRS Interest Charges (tax on top of tax)

IRS Penalties (tax on top of tax)

Liquor Tax

Local Income Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Payroll Taxes

Property Tax

Real Estate Tax

Recreational Vehicle Tax

Road Toll Booth Taxes

Road Usage Taxes (Truckers)

Sales Taxes

School Tax

Septic Permit Tax

Service Charge Taxes

Social Security Tax

State Income Tax

State Unemployment Tax (SUTA)

Telephone federal excise tax

Telephone federal universal service fee tax

Telephone federal, state and local surcharge taxes

Telephone minimum usage surcharge tax

Telephone recurring and non-recurring charges tax

Telephone state and local tax

Telephone usage charge tax

Toll Bridge Taxes

Toll Tunnel Taxes

Traffic Fines (indirect taxation)

Trailer registration tax

Utility Taxes

Vehicle License Registration Tax

Vehicle Sales Tax

Watercraft registration Tax

Well Permit Tax

Workers Compensation Tax

Comment